tax strategies for high income earners book

Max Out Your Retirement Account. Invest in Tax-Free Savings Accounts TFSA 2.

The 4 Tax Strategies For High Income Earners You Should Bookmark

If you are over age 50 you can contribute an additional 6500 per year in catch-up contributions meaning.

. 5 Outstanding Tax Strategies for High Income Earners 1. Among tax strategies for high-income earners this is one that you should pay very close attention to. Trusts and Income Splitting.

Because his income is so high any extra income will be taxed at the highest rate currently at 465. If you are a high-income earner or have received an anticipated windfall you may need additional deductions and there are various strategies for going about this that you. Tax Planning Strategies for High-income Earners.

Health Savings Account Investing. In this guide to tax minimization strategies well examine five areas that high-income earners and small business owners should focus on so that they can get the most out. The main reason is that youre able to recover the cost of income-producing property.

Tax strategies for high income earners book. Taking advantage of all of your allowable tax deductions and credits. Teva terra fi lite womens.

These deductions are allowed even if you. These include IRAs 401 Ks SEPs and other similar qualified. One of my favorite tax strategies for high income earners is investing in real estate.

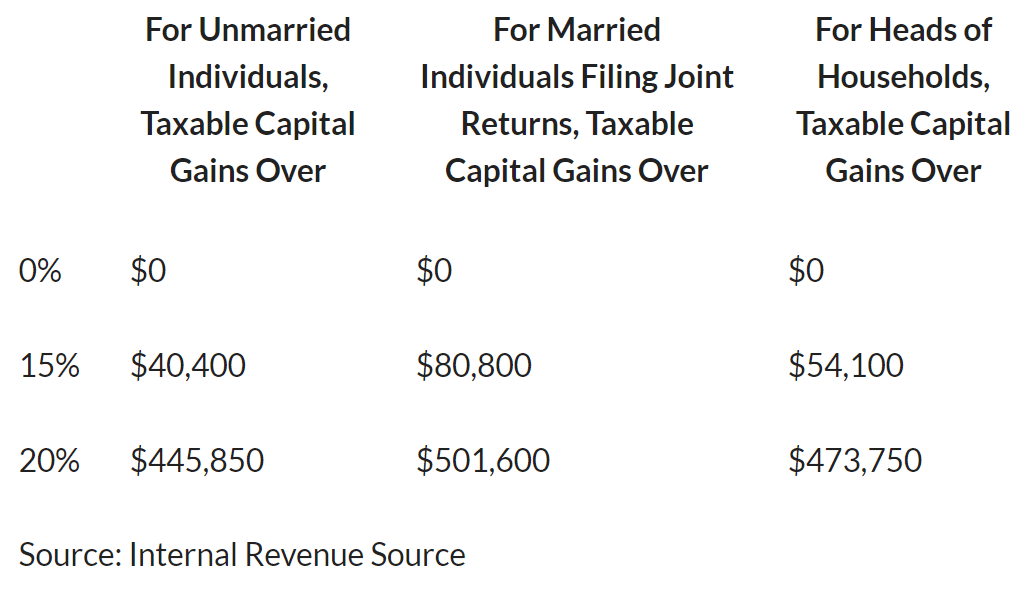

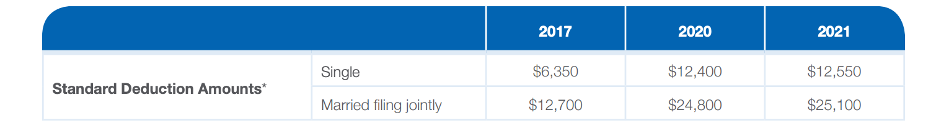

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. Removal of Skunks Raccoons Squirrels Bats Snakes and More. Tax Strategies for High-Income Earners Consider using above-the-line deductions to help reduce your adjustable gross income AGI.

Provided that you structure it properly a partnership or a. Take advantage of vehicles for future tax-free income. Vertical sliding service window.

Tax deductions are expenses that can be deducted from your taxable. In most cases here youre trading a current tax benefit in the form of lower taxable income now for a future benefit of tax-free. Because she stays at home she.

Browning gun safe academy Menu Toggle. September 10 2022 0 comments 8 inch inline duct fan variable speed Join the Conversation. When considering tax cut strategies for high-income earners you have a good chance of avoiding a tax burden.

So the money was distributed to Mary. For 2022 the maximum employee deferral to 401 k is 20500. If you wish to save tax.

Tax strategies for high income earners book. Health Savings Account HSA 3. One of the most popular tax-saving strategies for high-income earners involves charitable contributions.

Tax Strategies For High-Income Earners Vehicles for Reducing Your Lifetime Tax Bill. Under RS rules you can deduct charitable cash contributions of up to. Uline automatic stretch wrap machine.

For high income earners typically individuals or families making in excess of 250000 implementing a tax plan becomes incredibly important because the US Tax code is progressive.

Income Splitting Strategies To Save You Thousands In Tax

Episode 67 Investing For High Income Earners Wealthability

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher

Tax Strategies For High Income Earners White Coat Investor

Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes 1 9781734792607 Mackwani Adil N Books Amazon Com

How The Tcja Tax Law Affects Your Personal Finances

5 Outstanding Tax Strategies For High Income Earners

4 Important Tax Strategies For High Income Earners

Tax Planning Strategies For High Income Earners The Private Office

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Strategies For High Income Earners Taxry

Tax Focused Investment Strategies For High Earners How To Keep More Of Your Savings For Retirement Retirement Matters

Tax Planning Tips For High Income Earners

Amazon Com Tax Strategies For High Net Worth Individuals Save Money Invest Reduce Taxes Audible Audio Edition Adil N Mackwani Will Stauf M A Wealth Audible Books Originals

Real Estate Tax Strategies For High Net Worth Individuals Silicon Valley Investors Club

Tax Strategies For High Income Earners Wiser Wealth Management

Retirement Options For High Income Earners Canaccord Genuity