dupage county sales tax on food

What is the sales tax rate in Dupage County. Illinois has a 625 sales tax and Dupage County collects an additional.

Business Climate Choose Dupage

The aggregate rate for sales tax in the DuPage portion of the Village is 800.

. Food Drug Tax 175. 1337 rows 2022 List of Illinois Local Sales Tax Rates. The total sales tax rate in any given location can be broken down into state county city and special district rates.

What is the sales tax on clothes in Suffolk County NY. Restaurant meals and other prepared food and beverages are also subject to a 3 Hanover Park Food and. The average sales tax for a state is 509.

Average Sales Tax With Local. The aggregate rate for sales tax in the DuPage portion of the Village is 800. This is the total of state and county sales tax rates.

As of February 2014. A retailers occupation tax on the gross receipts. This is the total of state.

Sales tax returns or The Illinois Department of Revenue Form ST-1 are one of the most commonly audited forms or tax types in our state. Sales tax returns or The Illinois Department of Revenue. Use Tax applies if you buy tangible personal property and services outside the state and use it within New York State.

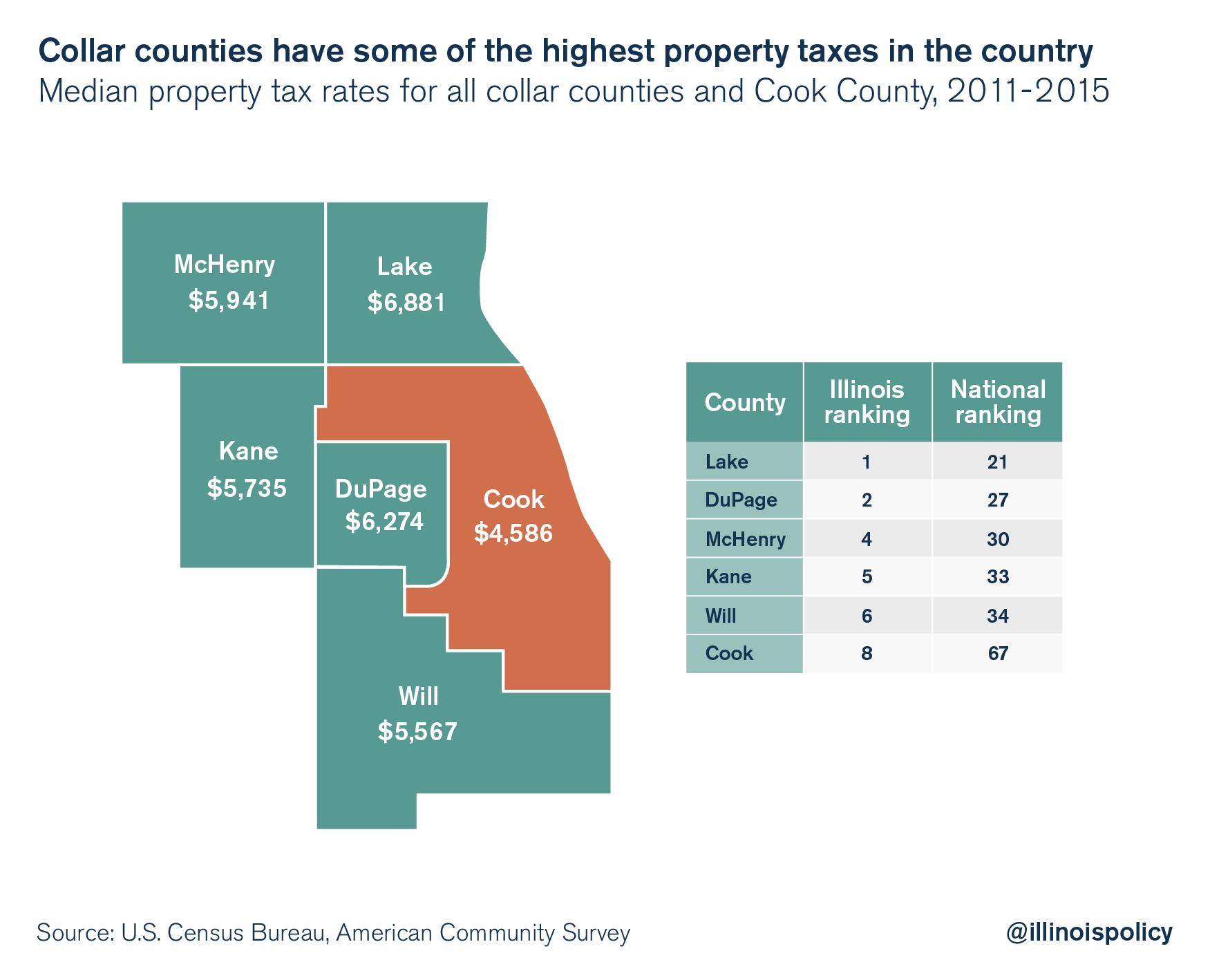

Important Chicago Illinois Sales Tax Information. The minimum combined 2022 sales tax rate for Dupage County Illinois is. The base sales tax rate in DuPage County is 725 725 cents per 100.

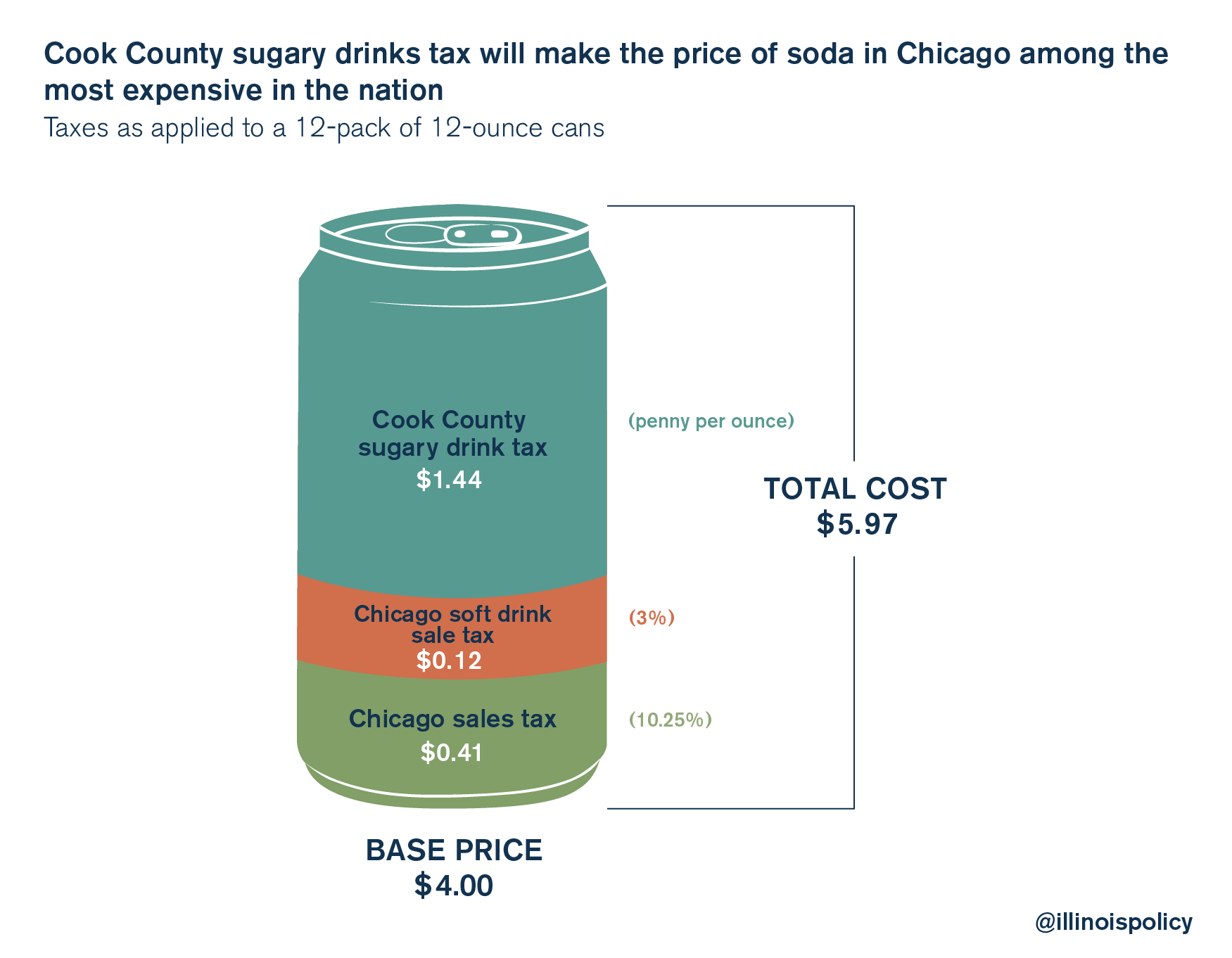

32 states fall above this average and 18 states fall below this average suggesting that the few states with a sales tax of 0 bring down. The Regional Transportation Authority RTA is authorized to impose a sales tax in Cook DuPage Kane Lake McHenry and Will counties. In addition to the Illinois state tax of 625 percent restaurant food purchases in Chicago are subject to Cook County tax of 125 percent and a Chicago city tax of 125 percent.

The minimum combined 2022 sales tax rate for Dupage County Illinois is. The state of Illinois imposes a sales and use tax of 625 percent on food soft drinks and alcoholic. The Dupage County sales tax rate is.

DuPage County Board Chairman Dan Cronin DuPage Water Commission Chairman Jim Zay and members of the County Board celebrated the sales tax decline with a cake at the May 24. Lowest sales tax 625 Highest sales tax 115 Illinois Sales Tax.

Atlas Plat Book Dupage County Illinois Il 1874 Reprint Genealogy History Ebay

Egregious Error Costs Dupage Millions In Marijuana Tax Revenue And Two Officials Trade Blame

List Of Real Estate Tax Exemptions In Dupage County

Local Governments Begin To Measure Effect Of New Illinois Sales Tax Collection Fee The Civic Federation

Dupage County Birth Certificate Fill Online Printable Fillable Blank Pdffiller

Vtg 1924 Dog Tag License Tax Registration Dupage County Illinois Antique 2724 Ebay

Dupage County Appearance Form Fill Out And Sign Printable Pdf Template Signnow

Cook County Increases Its Sales Tax By One Percentage Point The Civic Federation

Fillable Online Dupage County Health Dept Form Westmont Bbq Fax Email Print Pdffiller

Julie Renehan For Dupage Facebook

Dupage County Missed Out On Cannabis Sales Tax Money

New Cook County Soda Tax Upheld In Court

News Updates Dupage County Chairman Dan Cronin

Dupage County Illinois Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

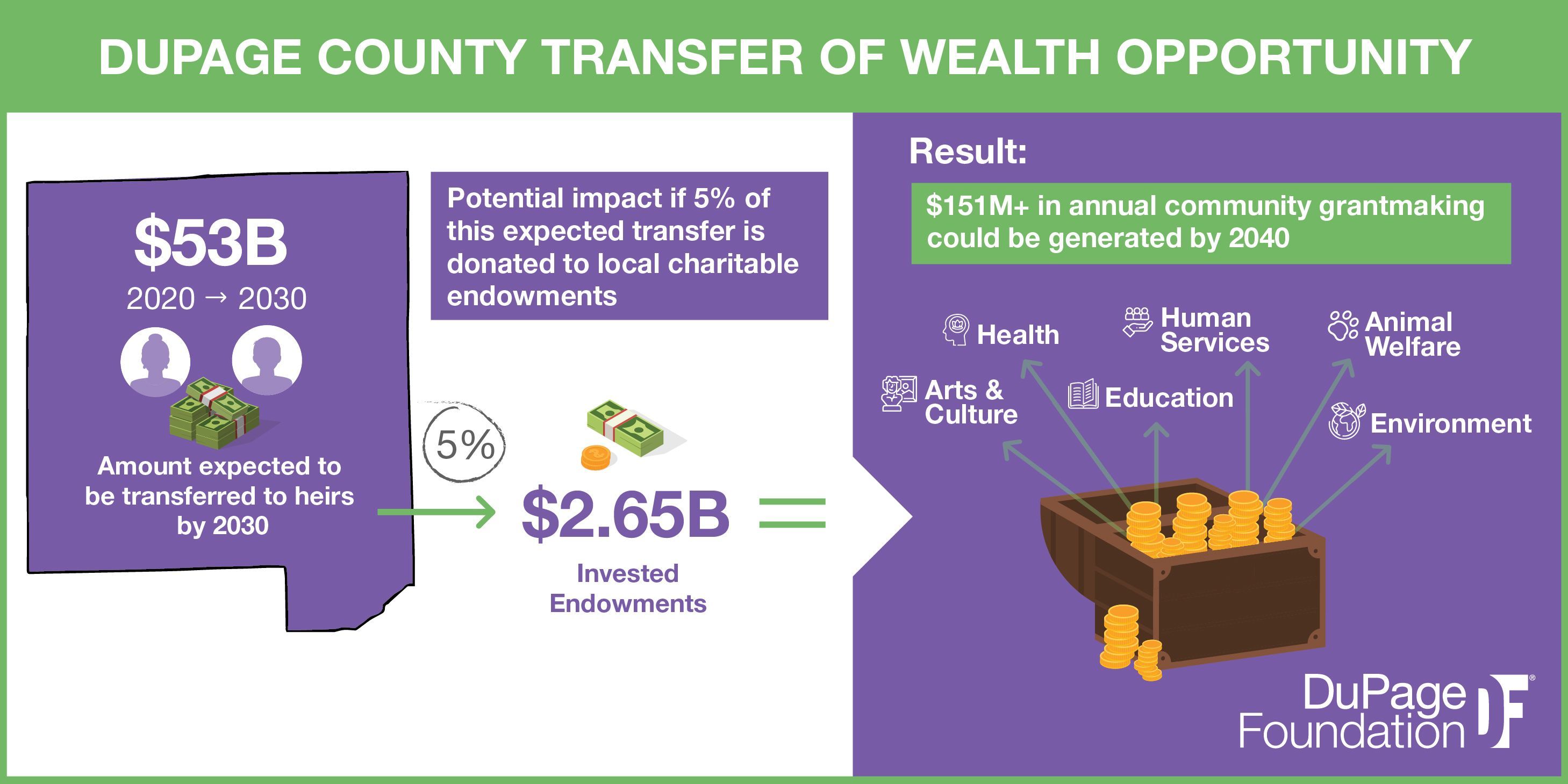

Transfer Of Wealth Dupage County

Dupage County Taxes Tax Rate Information Dupageblog Com

Food And Beverage Tax Goes Into Effect Jan 1 In Downers Grove Downers Grove Il Patch

Illinois Taxation Of Dietary Supplements Food Replacement Avalara

Dupage And Lake County Tax Bills Starting To Arrive Chicago Real Estate Closing Blog